Council Set to Offset High-End Tax Break With Rent Relief: The ol’ homestead – News

[ad_1]

Steve Adler (Photo by John Anderson)

The city council held the first of two votes needed to double the property tax exemption on homesteads to 20% on Thursday June 3rd. This tax break will apply to all homeowners, although it will benefit disproportionately high value real estate and will not provide a direct benefit to the majority of Austin households that rent. The council also approved an increased exemption for homeowners living with a disability or over 65 years of age.

A final vote is expected on June 10, fulfilling a 2014 election promise made by Mayor Steve Adler that has since lost momentum, in part due to an interpretation of tax laws by the State Audit Office that limited cities’ ability to redeem exemptions with income from other properties on their tax lists. But Auditor Glenn Hegar has revised that stance and paved a way for the council to go to 20%.

Adler recognizes that property taxes, like sales taxes, are regressive; they make up a larger proportion of the cost of living for lower-income homeowners, and tax exemptions are more valuable to wealthier taxpayers in proportion to the higher property value. But he says state laws limit cities’ ability to provide blanket exemptions, and wealthy Austinites, who enjoy greater tax breaks, also bear a greater share of the city’s property tax burden.

Still, Adler told the Chronicle, the guiding principle for him was how a higher exemption would affect city services. Now that the city’s tax cut can be income neutral, Adler believes that now is the right time to go to 20%. “Even if we didn’t give the tenants any additional money,” Adler said, referring to the city’s ongoing rent relief efforts, “if it were still the right thing to do with their house, it doesn’t care what the tax break is for the wealthy homeowner. They care about the relief they get that allows them to stay where they are. “

The Council also voted for staff to take the steps required by national law to aim for an 8% increase in property tax revenues in 2022, should the Council so decide when the budget is adopted in August. Legislation in 2019 had lowered the “revenue cap” from 8% to 3.5% above which cities would need voter approval for their tax rate. However, the law provides an exemption for cities that experienced disasters in the previous year and allows them an upper limit of 8%. Austin and all of Texas are meeting these criteria due to COVID-19 and winter storm Uri, but the council has made no commitments to go above 3.5% at this point.

Doubling the homestead exemption will shift approximately $ 27 million in tax burden to other property owners. According to the city’s budget office, this shift is mainly due to multi-family houses and “residential properties without a home” – mostly single-family houses.

Shift the load

Doubling the exemption for homesteads naturally shifts the tax burden to other property owners. According to the city’s budget department, this shift is being driven primarily by apartment complexes and “residential properties without homesteads” – which, according to employees, consist mainly of single-family homes. They’re taking on approximately $ 13.6 million of the total $ 27 million home tax cut. Other commercial property owners (office, retail, etc.) will take on approximately $ 11 million. (These numbers all assume a tax rate based on a 3.5% increase in sales.)

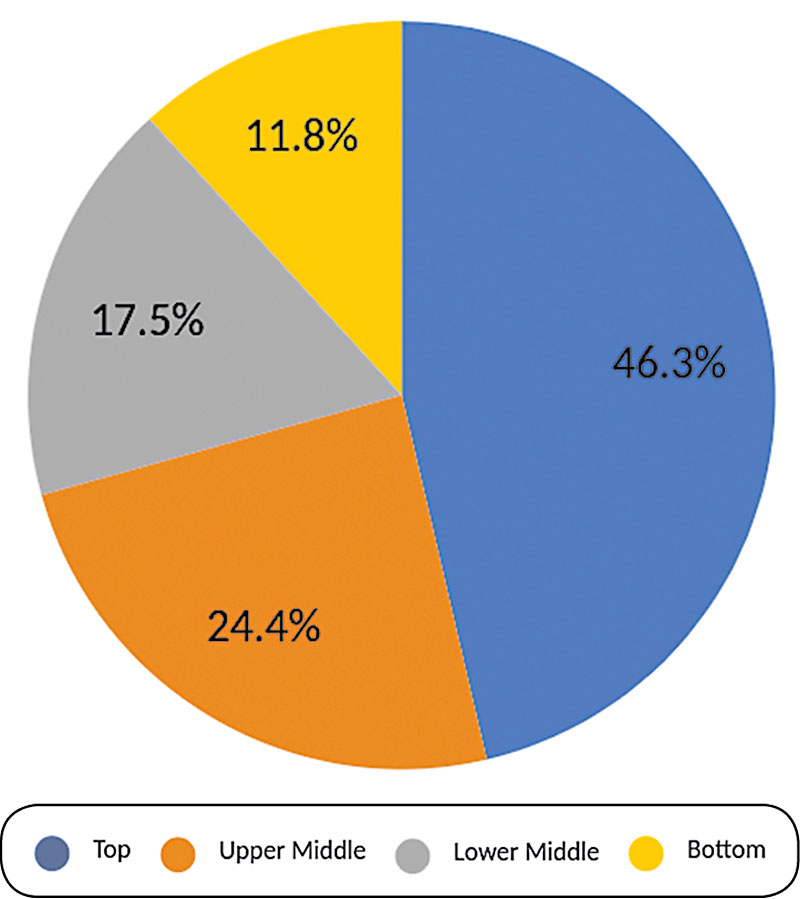

The Budget Office says the resident owner of a $ 400,000 home (roughly the average home value in Austin) would save about $ 141 in property taxes annually. However, the savings are not evenly distributed among all Austin homeowners above and below this median. Using data from the Travis Central Appraisal District, “proponent of housing capital” (according to his Twitter bio) Tanner Blair – who estimates the total tax credit at $ 31.6 million – calculates that 70% of that amount is given to the top 50% go to the homesteads. whereby the best 25% of the homesteads go away with 46% of the tax break (see graphic, next page). In the meantime, taxes for non-homesteads would rise by $ 21 per $ 100,000 of taxable value. How this will translate into rents is difficult to predict as several factors influence Austin’s overheated rental market; After a slight decrease in 2020, average rents are rising again.

However, the exemption for senior citizens and people with disabilities is flat-rate according to state law. The council approved a $ 25,000 increase in this tax exemption to $ 113,000, lowering the expected tax burden for these homeowners by about $ 3.52 in 2022. As Councilor Pio Renteria pointed out, any interruption to the relentless tax hikes could help keep the longtime East Austinites in their place. “The value of their property and taxes has just gone up and they take their money and they go,” Renteria said. “So we have to give our people some relief here.”

Push back?

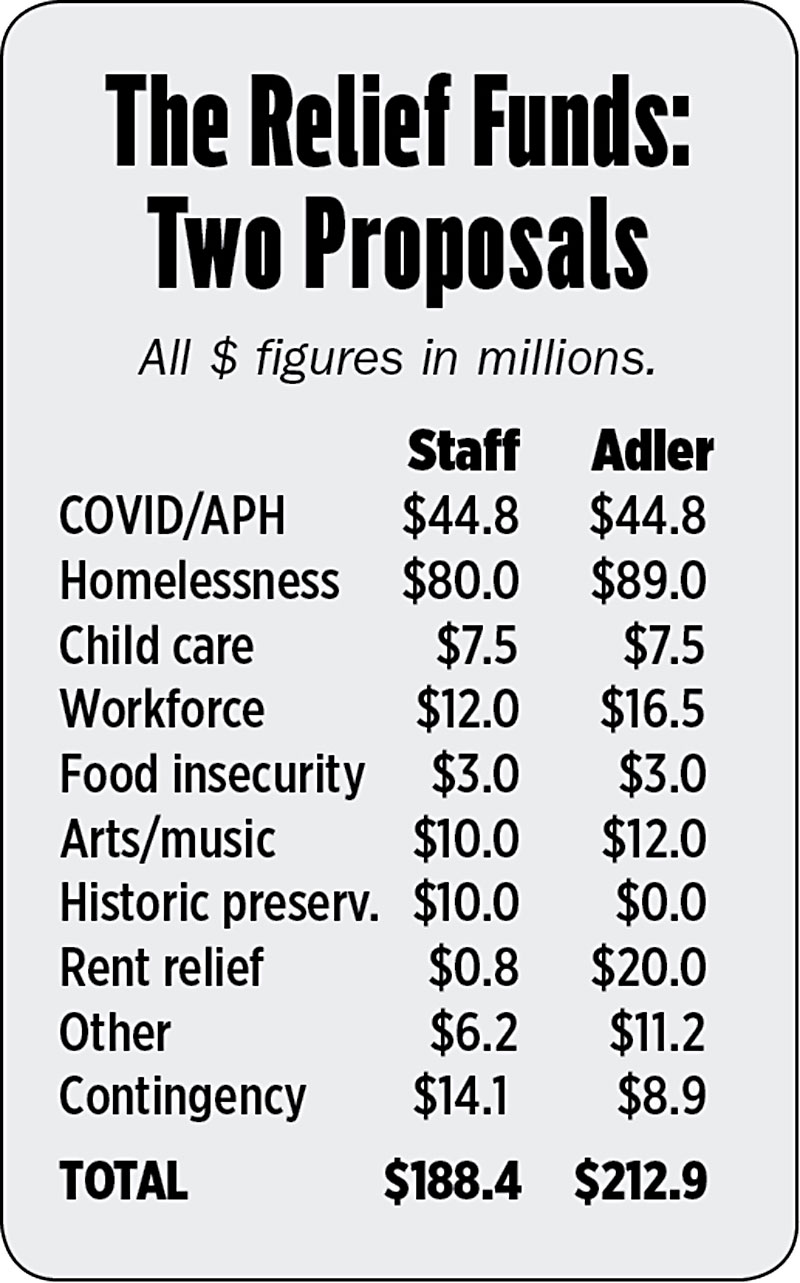

As for the rent reduction that CM Greg Casar and Mayor Pro Tem Natasha Harper-Madison have made a condition of their support for a 20% exemption, the council is reviewing its options. This includes approximately $ 188 million in federal funding the city will receive through the American Rescue Plan Act; The Council continued its deliberations on a spending framework for these funds at a special meeting convened on June 7th.

ARPA money must be issued before December 31, 2024. In March, the council directed staff to focus on four spending priorities where a combination of local, regional, private and philanthropic spending with federal funds could be used to address “transformational” and generational shifts: homelessness, early childhood care and education, Personnel development as well as food and housing insecurity.

The staff’s draft framework in March envisaged spending $ 236.4 million from now through the end of FY 2022; Of this, $ 40.6 million would come from the General Fund’s excess reserves (above the threshold set by council policy), with approximately $ 20 million as a direct rental discount. Now, however, the Budget Office predicts that there will be only $ 28.4 million in surplus. The latest recruitment proposal spends $ 88 million on homelessness (including $ 4.2 million in shelters and support for service providers in expanding operations), $ 20 million on cultural and heritage conservation, and $ 8 million $ 7.5 million for human resource development, $ 7.5 million for childcare, $ 3 million for food insecurity, $ 1.5 million for Colony Park Sustainable Community Health Center, and $ 800,000 for rent relief. Another $ 14.6 million would go to an emergency fund to supplement these four priorities over the next 16 months, or to fund something else if needed.

The council generally agrees with this distribution of the ARPA windfall, but some members are concerned about putting as much of the funding as possible on the ongoing homelessness response with no firm commitments from other partners like Travis County to do the same. According to Adler, as he told his colleagues, “If we do this on a large scale, it is part of a larger increase. That scale depends on the entire community saying, ‘Yes, this is a priority’ and coming in of a similar order of magnitude, [but] It will take someone to go first. “

Proportion of services from 10% to 20% HS deduction (Courtesy Tanner Blair)

At the June 7 meeting, staff found that the tenant emergency aid program had helped approximately 6,000 people and another 4,000 are waiting for help. This is a problem for Casar and Renteria, who are trying to overcome their peers’ concerns about jumping into reserves even when cities are staring down an evacuation crisis; The federal moratorium on evictions is due to expire on June 30th.

An alternate version of the Adler-designed staff spending plan adds the $ 20 million for rent relief, while increasing ARPA spending on staff and live music support, but reducing spending on monument preservation and proposed staff emergency fund. Casar also revised his own amendment to move $ 20 million from reserves so that City Manager Spencer Cronk can restore funds when they are “no longer needed to prevent widespread evictions”.

Meanwhile, Harper-Madison’s resolution Equitable Transit Oriented Development, which was postponed several times as she and CM Ann Kitchen negotiated the terms, is back on the agenda, as is two items related to the purchase of a Candlewood Suites hotel in Northwest Austin across town for conversion into supportive housing for people emerging from homelessness. The authorized purchase price of 10811 Pecan Park Blvd. by $ 50,000, and a second point entitles a contract for just under $ 3 million with Caritas in Austin to provide the services at the site after its opening. Predictably, Williamson County Judge Bill Gravell continues to snort at the council’s efforts to accommodate the homeless in its jurisdiction and in Council District 6, represented by the equally skeptical Mackenzie Kelly.

The council is expected to return on July 23rd to begin formal review of the budget for fiscal year 2022.

[ad_2]